What are the Insurance Prices in Daphne AL like? Home insurance is a unique thing in Southern Alabama. It is a nice get away in the winter, and the gulf coast makes it enjoyable year round. But due to hurricanes in the summer, insurance prices can be high. Here’s what the cost of homeowners insurance in Daphne looks like.

What determines insurance prices in Daphne:

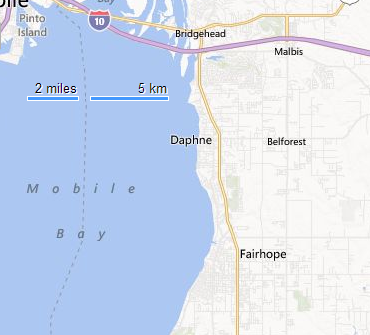

- Distance from the Mobile Bay and the Gulf of Mexico. Wind insurance is expensive. I would say it is ¾ of the total price you pay. But let’s get real, if you live in Daphne, wind is the threat.

- Distance from the nearest fire department, hydrant, and the fire department’s protection class.

- Total insured value.

Let’s use this model home and put it in different parts of Daphne to see what the insurance price comes out to be. The house is new, has a hipped roof, architectural shingles, and is brick. Insuring only the house, these are the coverages:

1) Dwelling $200,000 and $0 for all others

| Dwelling | 200,000 |

| Other Structures | 0 |

| Personal Proptery | 0 |

| Loss of Use | 0 |

| 1) 0 – 1/2 miles from the bay | $1900 + |

| 2) 1/2 – 1 miles from the bay | $1750 + |

| 3) 1 – 2 miles from the bay | $1750 + |

| 4) 2 + miles from the bay | $1300 + |

2) Add $50,000 for Personal Property

| Dwelling | 200,000 |

| Other Structures | 0 |

| Personal Proptery | 50,000 |

| Loss of Use | 0 |

| 1) 0 – 1/2 miles from the bay | $2350 + |

| 2) 1/2 – 1 miles from the bay | $2150 + |

| 3) 1 – 2 miles from the bay | $2150 + |

| 4) 2 + miles from the bay | $1600 + |

2) Add $10,000 Loss of Use

| Dwelling | 200,000 |

| Other Structures | 0 |

| Personal Proptery | 50,000 |

| Loss of Use | 10,000 |

| 1) 0 – 1/2 miles from the bay | $2450 + |

| 2) 1/2 – 1 miles from the bay | $2250 + |

| 3) 1 – 2 miles from the bay | $2250 + |

| 4) 2 + miles from the bay | $1650 + |

Cost of insurance in Daphne AL

You might be surprised to know that whether you add $50,000 worth of coverage to the building, other structures, personal property, or loss of use, the price stays the same. Why? It’s because the price is determined by the total insured value.

Please note that these prices are ball park figures for the model house above. These prices were calculated assuming that the homeowner or buyer is in good standing legally, financially, etc. In other words, you should have this:

- ok credit

- no foreclosure, repossession, or bankruptcy in 5 years

- preferably no claims within 5 years

- you can’t be a criminal

- can’t have violent pets

and the house has got to be a pretty safe house too. Insurance goes up when it comes to hazards like unfenced swimming pools or hot tubs, trampolines, or basically anything that the neighbor’s kid could run over to the house and hurt themselves on. Why is that important? It’s because that’s a lawsuit waiting to happen, and the insurance company could potentially end up paying $300,000 for that claim.

Make sure to check out a form where locals talk about the cost of insurance in Daphne.

Let us help you find out more information on homeowners insurance in Daphne AL!

Contact us and we’ll help you out!